30+ deduct home mortgage interest

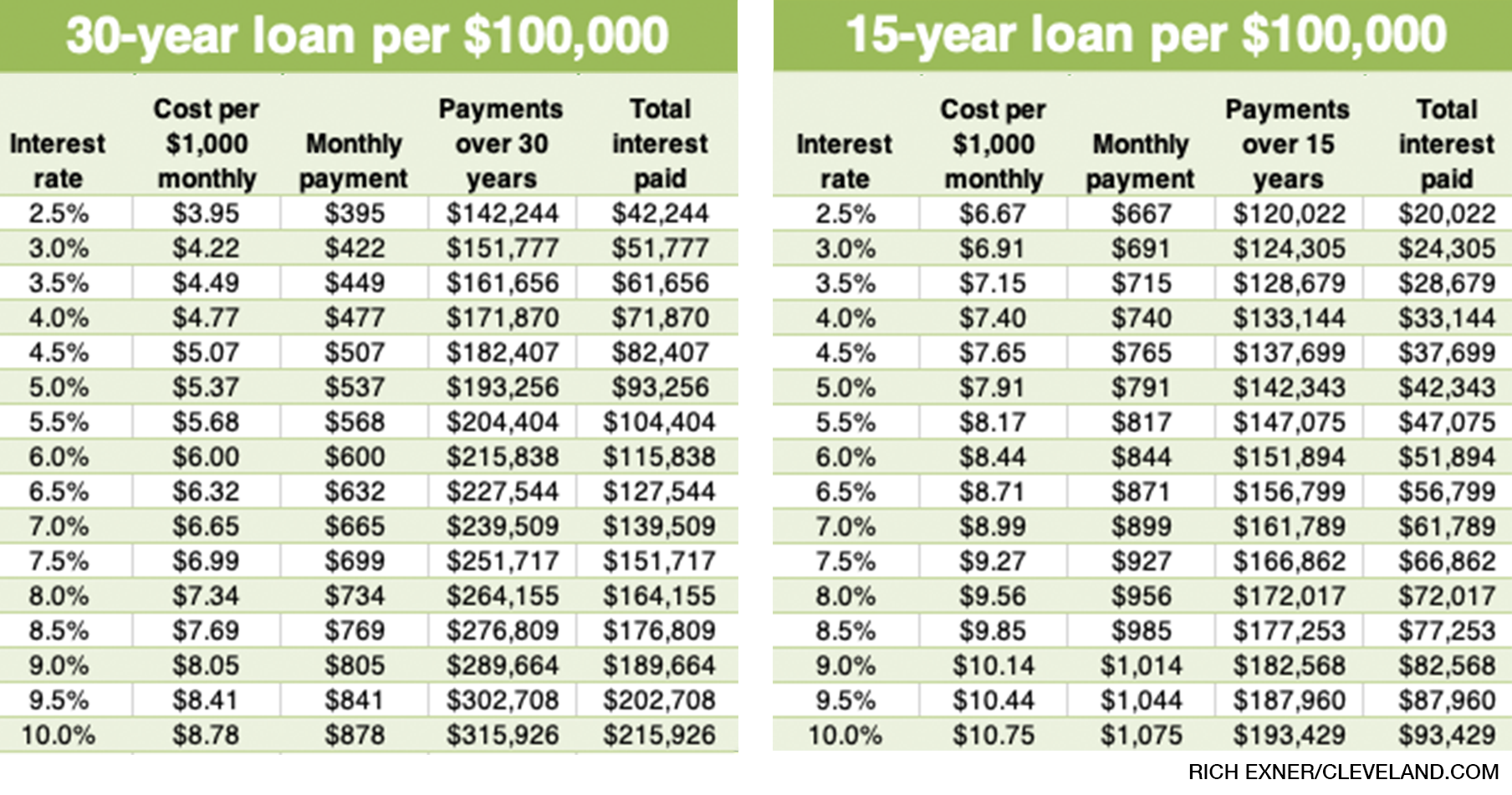

A month ago the average rate on a 30-year. Web 3 hours agoThe average 30-year fixed mortgage interest rate is 708 which is an increase of 7 basis points from one week ago.

:max_bytes(150000):strip_icc()/TaxDeductions-caca171ee3394a23b5bdac87ddaeb8c4.jpg)

Rental Property Tax Deductions

Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage.

. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. In the year you. Our Trusted Reviews Help You Make A More Informed Refi Decision.

Web So lets say that you paid 10000 in mortgage interest. Homeowners with a mortgage that went into effect before Dec. Web 2 hours agoTodays average rate on a 30-year fixed-rate mortgage is 713 which is 004 higher than last week.

30 x 12 360. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Web Tax break 1.

Now is the Time to Take Action and Lock your Rate. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Web If you took out your mortgage on or before Oct.

To get an estimate and breakdown of your interest. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web Deducting points means you can deduct 130th of the points each year if its a 30-year mortgagethats 33 a year for each 1000 of points you paid.

Homeowners who bought houses before. If you are single or married and. Divide the cost of the points paid by the full term of the loan in.

A basis point is equivalent to 001. Web 19 minutes agoThis deduction is limited to interest paid on a mortgage used to purchase the property or a mortgage arising from refinancing that mortgage. Web Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal on.

So your total deductible mortgage. Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is. Ad Rates are rising.

The average daily rate for 30-year fixed-rate mortgages was 714 up 1 basis point from 713 the previous day and up 7 basis. Web The average 30-year fixed-mortgage rate is 708 percent an increase of 7 basis points since the same time last week. Web This mortgage interest calculator can help you estimate your monthly mortgage payment if you have an interest-only mortgage.

15 2017 can deduct interest on loans up to 1 million. Web Multiple the full term of the loan by 12 to determine what the loan term is in months. Web A home mortgage interest deduction is a tax deduction that helps homeowners reduce their federal tax returns by claiming interest paid on home.

Web 5 hours ago30-year fixed-rate loans. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web Most homeowners can deduct all of their mortgage interest.

13 1987 your mortgage interest is fully tax deductible without limits. And lets say you also paid 2000 in mortgage insurance premiums. Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and.

In a 52-week span the lowest rate was 445 while the. Interest on the first. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Also if your mortgage balance is 750000.

Protect Yourself From a Rise in Rates.

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

Drop In 10 Year Treasury Yield Mortgage Rates Is Just Another Bear Market Rally Longer Uptrend In Yields Is Intact With Higher Highs And Higher Lows Wolf Street

How To Read A Paycheck Britannica Money

Mortgage Interest Tax Deduction What You Need To Know

Mortgage Interest Deduction Bankrate

Calculating The Home Mortgage Interest Deduction Hmid

Westpac Nz Economists Raise Their Forecast Ocr Peak By 50 Basis Points Interest Co Nz

With Mortgage Rates At Historic Lows Should You Join The Rush To Refinance That S Rich Cleveland Com

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

The Home Mortgage Interest Deduction In 2021 How To Deduct Your Mortgage Interest Youtube

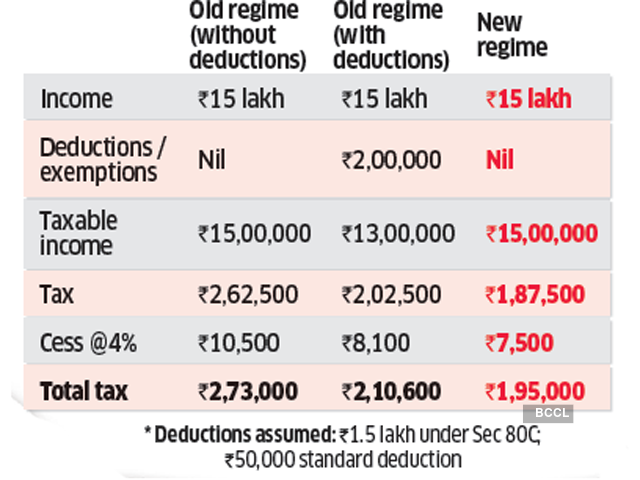

Income Rs 30 Lakh How The New Income Tax Regime Will Impact Taxpayers Under Different Incomes The Economic Times

Mortgage Interest Deduction A Guide Rocket Mortgage

Exploring Finance Homeownership Opportunity Cost

Home Mortgage Loan Interest Payments Points Deduction

Which Tax Regime Old Or New Is Best For Someone Whose Ctc Is More Than 15 Lpa Quora

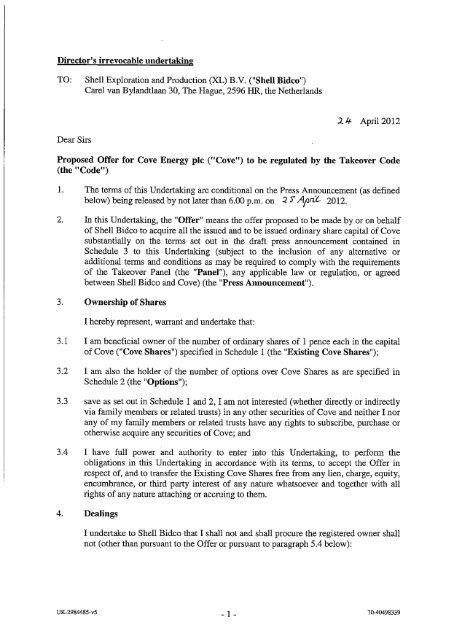

Director S Irrevocable Undertaking

4 Steps To Claim Interest On Home Loan Deduction Rr Housing India Pvt Ltd